AdvTax

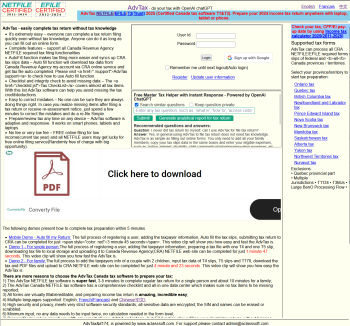

AdvTax from Aclasssoft Inc. positions itself as a fast and accessible online tax preparation solution for Canadians. It is certified by the Canada Revenue Agency for NETFILE/EFILE for tax years 2017 through 2024. The software supports Auto-Fill My Return, Notice of Assessment retrieval, ReFILE (from 2021) and covers many slips and forms for federal and provincial returns.

Its key appeal lies in the promise of speedy filing (the website claims a single-person return might be completed in three to five minutes), multi-device compatibility (smartphone, tablet, laptop), and a pricing model that allows either free filing for certain users or very low fees. The product claims full browser compatibility across major platforms and includes multilingual support (English, French and Chinese).

On the plus side, for simple to moderately complex tax situations — employment income, T4/T5 slips, basic investments — this software offers a very low-cost or no-cost entry point, especially helpful for low income filers, newcomers, or those comfortable doing their own return.

On the downside, the detailed certification notes list exclusions: the software does not support the Quebec provincial T1 component, certain specialist forms (like T2203 for multi-jurisdiction, T1134 for foreign affiliates), and it flags limitations for multi-jurisdiction tax situations. Also, while the “three-to-five minutes” claim is attractive, real-world returns often require review and caution, especially for credit/deduction accuracy. Customer support appears less prominent than major brand competitors, and users with very complex tax situations (large investment portfolios, non-residents, cross-jurisdiction assets) may still need more advanced software or professional advice.

In summary: AdvTax is a compelling, budget-friendly option for Canadian filers with standard tax situations who want a quick, online solution. For more complex filings, treat it as a self-help tool rather than full professional replacement.