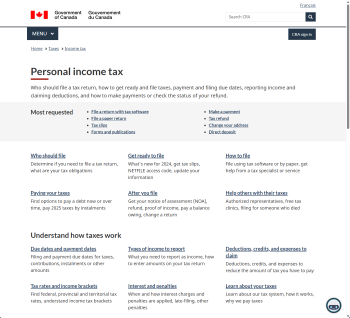

CRA - Personal income tax

This page from the Canada Revenue Agency presents a comprehensive overview of the personal income tax process. It outlines who must file a return, how to prepare (including gathering slips and choosing filing method), how to complete the return (reporting all types of income and claiming allowable deductions/credits) and the options for paying tax owing and checking refund status.

The site is particularly useful because it centralizes essential tasks: confirming your filing obligation, accessing tax-software or paper options, learning about deadlines, and understanding what income lines and deductions matter.

Strengths:

- Clear “who should file” section helps taxpayers confirm their requirement to file.

- Up-to-date information on preparing to file (e.g., gathering slips, using Auto-fill, NETFILE) gives actionable steps.

- Guidance on different income types (employment, self-employment, investment, foreign income) helps avoid omissions.

- Links to payment options and refund status mean the taxpayer can track their tax lifecycle in one place.

Limitations to note:

- The content assumes a relatively good level of familiarity with tax terminology; first-time filers or newcomers may still need supplementary help.

- While deadlines and tax rates are referenced, the page does not deeply navigate provincial/territorial variations for all readers (which may require a further look).

- The site is informational rather than conversational, so users seeking “tax planning tips” or complex scenario advice (e.g., cross-border tax, intricate investment income) may still need professional consultation.

In short: if you need to file your personal income tax, understand your obligations, prepare the necessary documentation, claim credits or deductions and pay any tax owing, this CRA page is a reliable starting point. For more complex situations you may use it as your reference base and then branch out to specialized guidance or consult a tax professional.